The battered briefcase, the barracking from the opposition benches and the perennial plea from the construction industry for a cut in VAT on refurbishment work.

Calls for a tax cut have fallen on the deaf ears of a succession of Chancellors.

But this year really is a case of “it’s now or never” for a lower VAT rate thanks to the extra boost the move will give to the ambitious Green Deal proposals.

The Government is banking on the Green Deal to create a whole new construction market as millions of homes and properties are made more energy efficient.

But the initiative is shrouded in a fog of uncertainty over funding and hampered by a crippling 20% VAT rate on building improvement work.

Cutting the tax to 5% would show the Government is serious about the scheme and provide a much needed boost to contractors and materials companies everywhere.

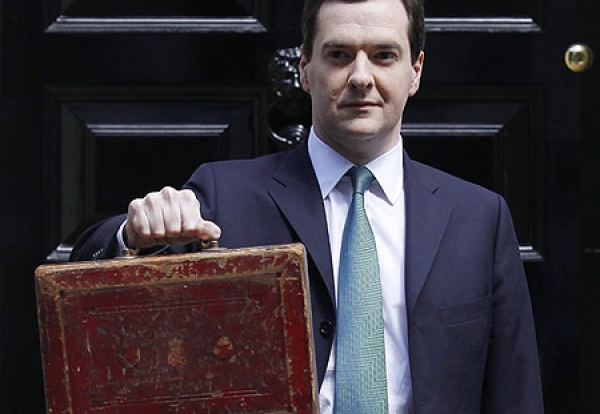

George Osborne is under pressure to come up with a “budget for growth” to shed his growing image as the cost-cutting Chancellor.

Reducing VAT on refurbishment work and green improvements is a winner all round.

It will stimulate the construction industry during a delicate period in its slow recovery while demonstrating that this Government is not just talk when it comes to energy efficiency.

Already some junior ministers are bleating about how we can’t afford a drop in the coffers created by a VAT cut.

But numerous studies have shown that cutting VAT stimulates demand meaning more tax cash for the Government in the long-term.

That is the crucial phrase. Ministers are expecting everyone to take the long-term view in terms of improving buildings while possibly holding back that work with short-term tax revenue worries.

Osborne has the chance to make a lot of friends with one simple measure on March 23.

Let’s hope for all our sakes he seizes that opportunity.