The alarm about renewed pressure on profits was sounded in today’s latest Construction Trade Survey for the last quarter of 2013.

The survey, which spans building contractors, SMEs, specialist contractors, civil engineers and product manufacturers, recorded three consecutive quarters of growth for the first time in over five years .

Even with all parts of the supply chain now pitched into a recovery, firms warned that orders and growth were down on the third quarter.

And building contractors in particular said they were seeing cost inflation eroding profits.

Dr Noble Francis, Economics Director at the Construction Products Association, said: “The recovery, which started in 2013 Q2, continued, though risks remain.

“The rises in activity were slower than in previous quarters, and orders for new work similarly decelerated, potentially highlighting uncertainty amongst contractors as to whether the recovery would be sustained.

“Growth was driven by the housing sector, though this was partially offset by a drop in repair and maintenance work.”

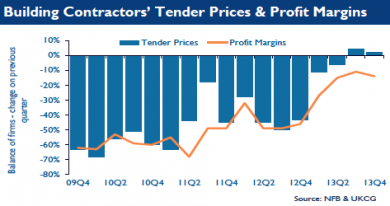

He said: “Tender prices rose again this last quarter, especially for building contractors and civil engineers. These rises, however, were mitigated by growth in cost inflation, largely owing to increased labour, energy and transport costs.”

As a result, most contractors reported a fall in profit margins despite the improving demand over the past 12 months.

Big building contractors, SMEs and civil engineers all reported rises in output, although lower than the levels seen in the third quarter.

Builders also warned that order levels were down against the third quarter, with only public housing showing more firms (9%) seeing a rise than a fall in orders.

Stephen Ratcliffe, Director UKCG, said: “While contractors reported a slowdown in output growth this quarter, the trend over the last year remains one of modest recovery.

“Unlike housing, the broader construction sector remains a lagging indicator and we would expect the main growth to come later than the wider economy.”

He added: “Rising labour costs highlight the need to tackle skills shortages as we move towards recovery, and for a clear pipeline of future work so firms have the certainty to invest in apprenticeships and other long term training programmes.”

Julia Evans, Chief Executive of the National Federation of Builders added: “These figures highlight the fragility of the construction industry’s recovery, which is being driven by house building.

“Ongoing investment and future prospects point to further growth for the construction industry as a whole but as the economy recovers, it is important for companies to be at least as vigilant about costs, cash flow and late payment as they were during the downturn.”

Key findings

- 15% of building contractors, on balance, saw activity rise in Q4 – down from the 43% figure in the previous quarter

- Building contractors reported falls in repair and maintenance activity

- 63% of building contractors said that costs rose in Q4 versus 49% in Q3

- A balance of 2% of building contractors reported that tender prices rose in Q4, although a balance of 14% reported that profit margins had continued to fall.

- 34% of building contractors, on balance, reported increased labour costs.

- 41% reported difficulties recruiting bricklayers and 32% reported difficulties recruiting carpenters.

- 76% of specialist contractors were paid between 30-60 days in Q4; late payment ranks as the most important factor affecting their business.

(300 x 250 px) (2).png)