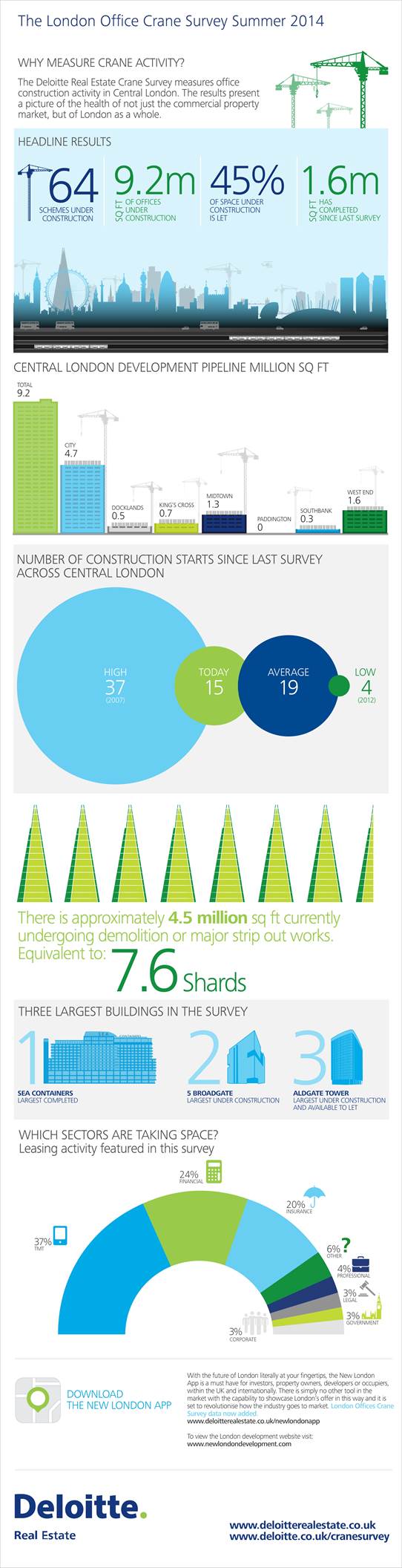

According to the latest London Office Crane Survey by Deloitte Real Estate around 9.2m sq ft is presently under construction across central London.

But office space is likely to remain in short supply over the next two years as nearly half of the new space being built is pre-let.

The report suggests that 2017 could be the year in which building work peaks, as the current phase of 4.5m sq ft of demolition begins to translate into completed schemes.

This is equivalent to knocking down nearly eight Shards.

Deloitte said office development has now been running at below average levels for five years.

This, combined with a clear rise in office take-up over the last 12 months, has resulted in availability falling to its lowest point since 2007.

Anthony Duggan partner and head of research at Deloitte Real Estate said: “Developers that started office development schemes at the first signs of economic recovery in 2011/12 are now reaping the rewards as their schemes complete at a time of reducing availability, increased tenant demand and rental growth.

“There is currently just 10 Grade A buildings in central London that are available to let as a whole, and only five which can offer an occupier 100,000 sq ft of space or more, which is severely limiting choice.”

The development pipeline shows that 2015 is set to see only 1.1m sq ft of available space delivered across central London adding to the already low levels of availability.

The reducing levels of supply is now beginning to be reflected in rising prime rents, with City and West End rents at £57.50 per sq ft and £110.00 per sq ft respectively, almost back to pre-recession levels.

Duggan said: “We expect a short-term squeeze on supply across central London and the lack of choice for occupiers is likely to drive a further rise in pre-letting over the next 12 to 18 months.

“While for some occupiers this will be the only option in securing the right space. An increased premium is likely as both supply constraints and rising construction costs continue to place upward pressure on rents.”

Duggan said: “Taking into account all proposed schemes that have the potential to start construction, new supply would only be marginally above the long-run average level.”

(300 x 250 px) (2).png)