The struggling contractor said it had now called in KPMG to undertake a detailed independent review of it contracts after its fifth profit warning since 2012.

In another blow, Balfour Beatty chairman Steve Marshall announced he will step down once a new group CEO and replacement non-executive chairman are found.

Balfour also revealed it plans to shut down unprofitable offices in the south west and Wales where losses have also been uncovered.

Marshall, executive chairman of Balfour Beatty said: “There has been inconsistent operational delivery across some parts of the UK construction business and that is unacceptable.

“Restoring consistency will take time and it has our full focus.”

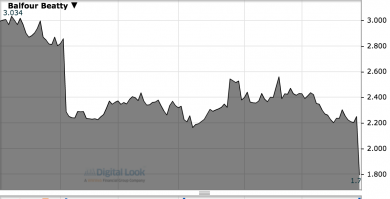

Shares in Balfour tumbled 22% in early morning trading as city analysts slashed earlier profit forecasts to zero.

Balfour Beatty shares have fallen by 40% since March

KPMG will focus on commercial controls, on ‘cost to complete’ and contract value forecasting and reporting at project level.

In this morning’s latest profit warning Balfour said KPMG would report back to the board by the end of the year.

Balfour said further unexpected losses on several contracts were uncovered after further internal reviews conducted in recent days.

Across construction services there has been a £30m write down within the troubled Engineering Services division.

It has made fresh write-downs of £20m within large London area building projects, £15m within regional construction, and £10m within major infrastructure projects.

In Engineering Services the £30m write-down relates mainly to previously highlighted problem contracts in London.

The trading statement said: “We have continued to experience programme slippage, resource and skills shortages, poor operational delivery and cost inflation pressures.

“The total number of problem contracts has increased to 25, from the 21 previously disclosed. Of these, 19 are due to reach operational completion in 2014.

“As we previously indicated, we have now withdrawn from bidding any contracts for other Tier 1 contractors in London, as well as withdrawing from bidding any new contracts in the South West region.

“The business will continue to pursue contractual entitlements in relation to the problem contracts and to recover monies that we believe are fairly due.”

The large London area building projects were transferred into Regional construction earlier in the year.

Several of these projects are now approaching completion, some have experienced further programme slippage and increases in cost to complete estimates.

In Regional construction Balfour has run into difficulties in the South West and Wales regions.

“These were previously highlighted as risks and we continue to take steps to reduce our exposure in these regions, where we are in consultation with our employees in regards to office closures, ” said the firm.

Scotland, the North and the Midlands were trading in line with expectations, but Balfour said it expected a fall in order intake as it was more selective about biding for work.

The adjustments to Major Infrastructure Projects profit expectation followed cost forecast revisions on a small number of projects where the scope of works has been changed but a commercial deal is still to be concluded.

The firm said work to refocus Construction Services UK and improve efficiency would continue.

Balfour Beatty expects savings as it transfers onto a common IT platform by the end of this year.

A circular covering details of plans to return £200m to shareholders following the sale of its US design consultancy Parsons Brinkerhoff will be issued next month.

This will take the form of a share buyback programme “subject to the board’s assessment of the trading environment at the time”.

In the summer Briatin’s biggest contractor shunned a £3bn merger with rival Carillion claiming it was not in the best interests of its shareholders.

As a result under UK takeover rules, Carillion is unable to make another approach for Balfour until February.