This rush to market has triggered sharp construction price inflation as nervous developers race to get building work underway with the best project delivery teams.

A report by cost consultant E C Harris into the Capital’s prime residential market warns many schemes in the pipeline will hit a bottleneck due to shortage of contractors able to deliver the required quality of work.

Mark Farmer, EC Harris Head of Residential, said: “The ability of the major players to source multiple delivery teams, as well as their intended Tier 2 fitting out supply chain, is the biggest immediate threat to project delivery.

“We are starting to observe real problems in the construction process.

“There is simply not the capacity out there to meet demand and many projects will undoubtedly fall by the wayside or experience delivery difficulties due to sheer lack of resources.

“Many developers and investors, when in a position to do so, are therefore looking to jump the queue and are paying premiums for construction so they can deliver on promises they have already made to their purchasers.”

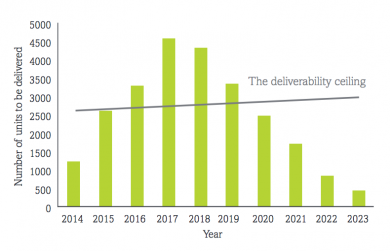

The number of luxury homes currently being planned or under construction in London hit a record high this year, with around £60bn of properties currently due to be delivered over the next decade, a 20% increase on 2013.

In volume terms this equates to a record 25,000 homes.

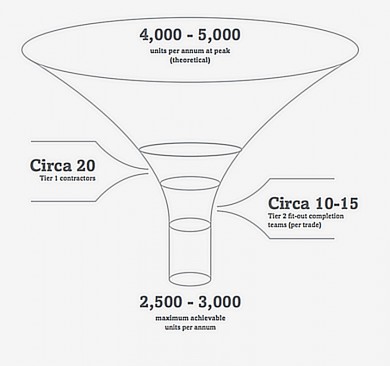

The report warns that there are just 20 tier one contractors and even fewer competent fit-out specialists with the right capability in the market.

Farmer said: “What is of more concern is the tier 2 trade contractor bottleneck that is evident, given the prospective volume in the pipeline.

“At the moment, the peak of potential development activity in 2017 could be double what may be possible for the competent and qualified residential construction market to deliver at current capacity.”

The report warns that many schemes may need to be delivered later to avoid this bottleneck, or will be forced to use inappropriate supply chains.

It states: “These schemes also face the risks of tender price inflation and ‘cover pricing’ as trade contractors pick and choose which projects to work on.”

The report warns that main contractors are struggling to get fitting out trades secured because of a lack of willingness by suppliers to fix prices early and lack of detailed design on which to base a final price without excessive risk transfer or refusal to accept that risk.

The authors warn: “This apparent Tier 2 supply chain capacity ceiling is potentially being suppressed as an issue on many projects as fitting out procurement is being deferred until after Tier 1 contractors are appointed or shell and core works have been procured.”

(300 x 250 px) (2).png)