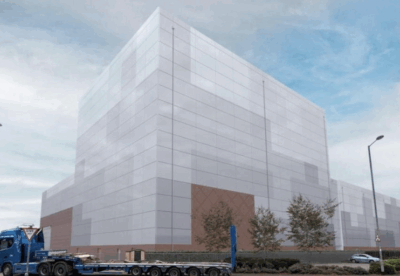

Barratt has rolled out a series of new housing types to allow a switch to greater use of offsite production and standardised product use.

Its commitment to driving down build costs using modern methods of construction came as the volume house builder reported a 12-year high in completions, up 9% to 8,314 in the first six months of the financial year.

During this period nearly 18% of homes were delivered using timber frame or large format block against 15% in the previous period.

David Thomas, chief executive, said Barratt planned to increase volumes by 3-5% a year, against a backdrop of some of its rival house builders reining back completions.

In the last six month of 2019, despite impacts from General Election and Brexit uncertainty, Barratt lifted revenue 6% to £2.27bn, generating a pre-tax profit up nearly 4% to £423m.

Operating margin softened slightly over the period to 19%.

He added that Barratt had become the first major house builder to set a science-based target to reduce carbon emissions in its operations by around a third by 2025.

Rival Redrow also revealed its first-half trading today with legal completions down 14% to 2,554 homes.

Pre-tax profit over the six months to December slid 15% to £157m on revenue down 10% at £870m.

John Tutte, executive chairman of Redrow, said that the market was fairly consistent across all of Redrow’s operating areas with London showing some early signs of improvement.

“The market in the first five weeks of the second half has been resilient with the value of reservations up 15% at £180m (2019: £156m).”

(300 x 250 px) (2).png)