The firm warns that delays in project conversion, a softening economic outlook and policy-driven cost escalations are compounding market fragility and limiting the pace of recovery.

In it latest forecast for the second quarter, G&T warns contractors are battling a mounting logjam of feasibility work as clients hesitate to press go on live projects.

The latest G&T market update warns that while enquiry levels remain healthy, actual workloads are flatlining.

Many schemes are stuck in early-stage limbo as developers fret over cost, value, and delivery risk.

Residential remains the hardest hit, with high-density housing schemes delayed or axed amid affordability concerns, soaring build costs, and red tape from the Building Safety Act.

Government pledges to boost housing are also being choked off by planning delays and stretched local authority resources.

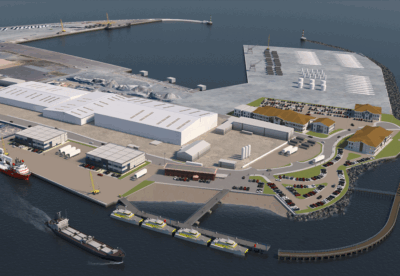

The forecasters say public sector and infrastructure work is more reliable, with long-term funding pipelines especially in water and energy.

But even in this sector, firms report delivery is often hampered by drawn-out approvals.

As a result of downward pressure, GT has ticked down tender inflation from 2.75% to 2.25% this year, with 2026 also marked down from 2.75% to 2.5%.

The cost consultant’s market survey revealed clients are increasingly focused on de-risking and won’t proceed unless compliance, ROI and value are all watertight.

It says that across the industry, confidence is muted.

Tier 1s and Tier 2s are staying cautious, pricing in risk premiums and limiting exposure to complex jobs. Many are chasing fewer tenders and prioritising margin protection over growth.

In some areas, competition is picking up—but only because workloads are thinning out. Risk-adjusted pricing is keeping overall build costs firm, despite softening demand.

“Looking forward, most market participants anticipate subdued growth and a patchy recovery for the remainder of 2025.

“However, pockets of resilience—particularly in infrastructure, public sector retrofit and fit-out—will provide some ballast, but the prevailing mood is one of cautious stability, with most waiting for clearer economic signals before re-engaging at scale.

“For now, stagnation—not contraction—best captures the current mood in UK construction.”

(300 x 250 px) (2).png)