Latest results for the six months to June 30 2025 saw revenue rise to £193m from £178m but pre-tax profits dipped to £8m from £12m.

Chief Financial Officer Chris McLeish said: “Pricing progression within the core business was modest, reflecting a more competitive market backdrop, which limited our ability to pass through cost inflation.”

The company was also hit by exceptional costs of £2.8m mainly due to its decision to quit the Glass Fibre Reinforced Concrete market.

Ibstock is expecting sales to continue growing for the rest of the year and has set an annual turnover target of £600m in the medium term.

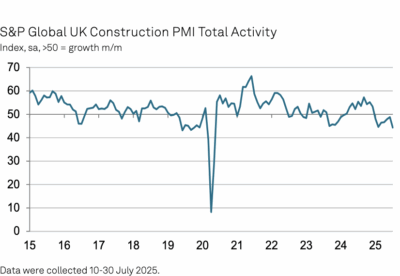

Joe Hudson, Chief Executive Officer, said: “The new-build residential market showed encouraging signs of recovery in the first half of the year, but activity is still well below normalised levels.

“As we plan for a period of further market growth, we have invested in restoring core capacity to meet demand. Whilst this has impacted margins in the first half, it will ensure we are able to benefit fully from the recovery as the market progresses.

“With both our core and diversified platforms now substantially in place to meet growing demand, I am confident in our ability to deliver on our medium-term revenue goals alongside improvements in profitability and returns driven by margin focus and significant operational leverage through the recovery cycle.”

(300 x 250 px) (2).png)