An Insolvency Service spokesperson said: “The Insolvency Service, acting on behalf of the Secretary of State for Business and Trade, has accepted a disqualification undertaking from Richard Howson for eight years for his conduct as a director of Carillion Plc.”

Howson, 55, was the CEO of Carillion from 2011 until 2017.

His ban follows an 11-year disqualification for former Carillion finance director Zafar Khan in June and a 12.5 year ban for former group finance director Richard Adam in July.

Background details released by the Insolvency Service show:

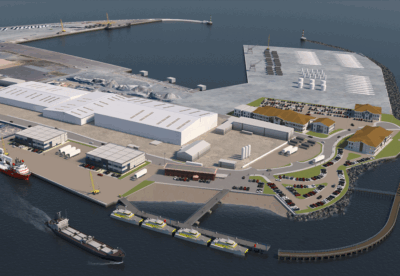

- Howson caused PLC to account for and report in its consolidated Financial Statements for the years ending 31 December 2015 and 2016, and as regards both revenue and costs, the performance of Carillion’s major construction contracts (namely, Royal Liverpool University Hospital; Battersea Power Station; Aberdeen Western Peripheral Route; Midlands Metropolitan Hospital; and Msheireb Phase 1(B) together, the Major Contracts) in a way which he ought to have known falsified and concealed the reality of the deterioration of the Major Contracts which in fact became loss-making, and Carillion’s consequent grave and deteriorating financial position.

- Howson caused Carillion to procure payments from Wipro in 2013 totalling £39.0m (comprising £25.0m in respect of Ecopod on the signing of an IP Assignment Agreement dated 06 December 2013 and £14.0m in respect of termination charges purportedly payable by Carillion pursuant to a Master Services Agreement dated 06 December 2013) and in 2014 totalling £2.0m (comprising the balance due under the IP Assignment Agreement). PLC wrongly reported and accounted for such payments as profits in the FY2013 Financial Statements, in breach of International Accounting Standard (IAS) 18, IAS 32 and the IFRS Conceptual Framework for Financial Reporting, resulting in an overstatement of profit by £39.0m and an understatement of net debt by £41.0m. Howson ought to have known of the false accounting, of the profit overstatement and of the net debt understatement and of the concealment from the auditors of the true picture regarding Carillion’s obligation to make repayments to Wipro.

- Howson caused Carillion to procure payments from Wipro in 2016 totalling £40.0m (comprising £20.0m in respect of Geneva, £10.0m in total in respect of certain intellectual property, in each case pursuant to “IP Assignment & Licence” agreements dated 09 December 2016; and £10.0m in respect of mobilisation costs, pursuant to Change Control Notes dated 09 December 2016). PLC wrongly reported and accounted for such payments as profit in the 2016 Financial Statements, in breach of IAS 18, IAS 32, IAS 38 and the IFRS Framework for Financial Reporting, resulting in the overstatement of profit by £34.4m (in relation to the Geneva Transaction) and understatement of net debt by £39.2m. Howson ought to have known of the false accounting, of the profit overstatement and of the net debt understatement, and of the concealment from the auditors of the true picture regarding Carillion’s obligation to make repayments to Wipro.

- In relation to the accounting periods ending 31 December 2013, 2015 and 2016, Howson ought to have known that Carillion had failed to disclose to its auditors information relating to the Major Contracts and the Ecopod and Geneva Transactions referred to above, which information he ought to have known was material.

- Howson caused PLC to prepare and publish Financial Statements for 2015 which Financial Statements he ought to have known did not give a true and fair view within the meaning of section 393 of the Companies Act 2006 and did not comply with IAS 11. The quantum of the misstatement for 2015 in the respect of the Major Contracts was £95.4m with the result that PLC’s profits should have been £65.3m rather than the £155.1m reported in the 2015 Financial Statements, and its net current assets £(57.0m) rather than the £41.5m reported in the 2015 Financial Statements.

- Howson caused PLC to prepare and publish Financial Statements for 2016 which Financial Statements he ought to have known did not give a true and fair view within the meaning of section 393 of the Companies Act 2006 and did not comply with IAS 11, IAS 18, IAS 32, IAS 38 and the IFRS Framework for Financial Reporting.The quantum of the misstatement for 2016 in respect of the Major Contracts was £179.2m and in respect of the Ecopod and Geneva Transactions was £29.3m with the result that PLC should have reported a loss of £(61.7m) rather than the profit of £146.7m actually reported in the 2016 Financial Statements, and net current assets of £(232.5m) rather than the £52.4m actually reported.

- Howson caused PLC to make Market Announcements on 07 December 2016, 01 March 2017 and 03 May 2017 which he ought to have known were misleading as to the reality of Carillion’s financial performance, position and prospects, and were in breach of Listing Rule 1.3.3R and Article 15 of the Market Abuse Regulation.

- Howson caused PLC to make a 2016 final dividend payment of £54.4m, which was paid on 09 June 2017, which payment he ought to have known, could not be justified by reference to the FY2016 Financial Statements because those Financial Statements were not properly prepared in accordance with the requirements of the Companies Act 2006 and did not give a true and fair view. Furthermore, Howson ought to have known that the 2016 final dividend payment was not in the interests of PLC, its members or its creditors and was not one that PLC could reasonably afford to make in view of its true financial performance.

(300 x 250 px) (2).png)