The Bank of England confirmed today that the Funding for Lending (FLS) scheme will no longer be aimed at mortgage loans.

The focus will switch instead to encouraging bank lending to small businesses.

Funding for Lending provides up to £60bn to banks and building societies to lend to businesses and individuals.

The Bank said: “Although the growth in household loan volumes remains modest, activity in the housing market is picking up and house price inflation appears to be gaining momentum.

“As a result there is no longer a need for the FLS to provide further broad support to household lending.

“The changes we are making have no implications for HM Government’s Help to Buy scheme, which is designed to address the specific issue of access to mortgages for borrowers without large deposits, unlike the FLS which was designed to boost lending more generally.”

The move led to a large-scale sell-off in the City of major house builders’ shares.

Governor of the Bank of England Mark Carney said: “Over the past year the Funding for Lending Scheme has contributed to the recovery by helping to significantly improve credit conditions, especially for households.

“The changes announced today refocus the FLS where it is most needed – to underpin the supply of credit to small businesses over the next year – without providing further broad support to household lending that is no longer needed.”

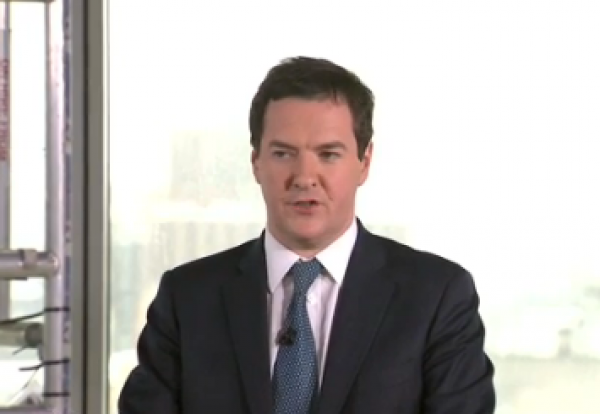

Chancellor George Osborne said: “Now that the housing market is starting to pick up, it is right that we focus the scheme’s firepower on small businesses.

“Small firms are the lifeblood of our economy. That’s why we’re reforming the banks, introducing the employment allowance and now focussing the Funding for Lending Scheme to support them”.

May 2025.gif)

.gif)