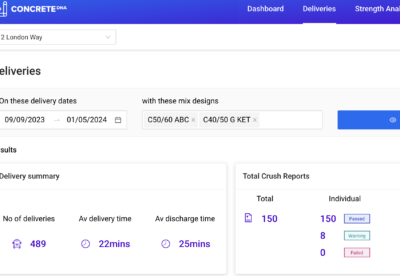

Earnings Before Interest, Tax, Depreciation & Amortisation rose by 17% to €31.1m for the 12 months ending 31 December 2020 on revenue steady at €233m

The strong performance comes despite the unprecedented twin challenges of Covid and Brexit during the period, which included a halt on all non-essential production at the company’s multiple manufacturing plants during Q2.

Last year also saw the company take on a rebrand from Quinn to Mannok, marking the culmination of a six-year transformation and investment programme that saw sales and employment increase by 44% and 25% respectively.

Mannok’s significant investment also continued, to the tune of €6.7m in the period, bringing total investment to €66m since the acquisition of the businesses in December 2014.

Performance Highlights:

- EBITDA increased from €26.6m to €31.1m. Revenue remained materially consistent at €233m, demonstrating strong resilience to the impact of Covid-19 on trading during the year.

- 2020 saw good sales and margin increases across Cement and Packaging, partly offset by higher raw material costs for Insulation products.

- Covid 19: Safety was the No. 1 priority in 2020 with extensive measures put in place to protect staff and customers.

- Positive response internally and externally to new identity with rebranding ongoing across Mannok’s entire fleet, premises and product range.

- Cash generation from operating activities improved by over 44% from €21.7m to €31.3m which aided a reduction in net debt in the period of €19.4m

- Investment of €6.7m in the period, primarily in manufacturing technology and capacity enhancement, bringing total investment to €66m since the acquisition of the businesses in December 2014, with a further €6.1m of investment already in train for 2021.

Liam McCaffrey, Chief Executive Officer said: “The safety and welfare of our staff and their families has been, and remains, of paramount importance through the pandemic. As an organisation with operations on both sides of the border, we are enormously grateful for the support and commitment of our 800+ colleagues in helping to navigate the twin challenges of Covid-19 and the Brexit transition.

“Careful resource planning and operational agility, facilitated by the significant investment we have made in our sales support, logistics and customs management infrastructure, have ensured uninterrupted supply chains for our customers across the construction and food industries on the island of Ireland and in Great Britain.

“Post the initial lockdown, trading recovered strongly in the second half of the year, supported by approximately €66m of new investment over the past six years.

“While the business has experienced some impact on trading activities over recent months, with a number of customer projects being delayed as a result of Covid-19, underlying demand has remained strong.

“Given our ongoing exposure to the food and construction sectors, the very positive response to our rebranding and the potential tail-wind of a vaccine-driven economic recovery, the outlook for 2021 is positive.”

Chief Financial Officer, Dara O’Reilly added: “Through timely adjustment to our manufacturing levels during the initial lockdown, we succeeded in managing our cost base and resource allocation whilst ensuring seamless supplies to essential industries.

“We continue to monitor our markets very closely as well as the supply of key input materials for our Insulation and Packaging businesses in particular. Notwithstanding a positive outlook and good demand, we are expecting some margin compression as a result of inflationary cost pressures in 2021.”

Mannok comprises two key divisions, Building Products and Packaging. Its key activities are the manufacture, of cement, concrete, quarry, insulation materials and products, as well as the manufacturing of packaging products, mainly for the food industry.

.gif)