The latest Markit/CIPS UK Construction PMI survey for August also recorded the steepest rise in rates charged by subcontractors since the survey began in April 1997.

Delivery times were also at their longest since 1997 as suppliers struggled to keep up with demand.

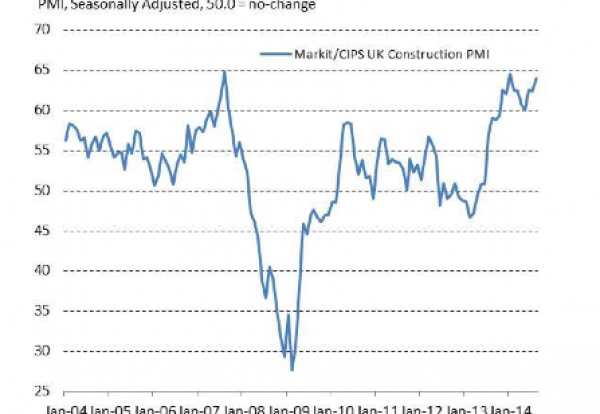

The index rose strongly to 64.0 from 62.4 in July as the headline figure posted above the 50.0 no-change threshold for 16 months running.

David Noble, Group Chief Executive Officer at the Chartered Institute of Purchasing & Supply, said: “The resurgence in construction has entrenched itself after a summer of blistering growth but builders should prepare for growing pains this autumn as the sector labours to recover lost capacity.

“Buoyed particularly by investment into civil works, construction output grew at the fastest pace for seven months in August, whilst activity continued to expand in housing and commercial construction.

“Confidence for the next 12 months also remained high as businesses continue to invest for the future.

“Nevertheless, an encouraging 15 months of sustained employment growth, the longest since 2006 – 2008, is revealing a major skills shortage in the sector.

“August saw the quality of subcontracted work deteriorate at the fastest rate since the survey began in 1997, combined with a record reduction in the availability of subcontractors and a record rise in the rates charged.

“The sector is struggling to find enough skilled tradesmen to keep pace with new work and the labour market will continue to put pressure on costs until the next wave of apprentices begin to enter the jobs market.

“Indeed, across the supply chain, delivery times have seen the sharpest rise since the survey began, with input prices growing at the fastest rate since July 2011.

“With the UK’s appetite for building materials growing throughout the summer, suppliers are struggling to ramp up production to pre-crisis levels.”

Tim Moore , Senior Economist at Markit and author of the Markit/CIPS Construction PMI, said : “UK construction firms saw one of the sharpest rises in output for seven years in August, with increasing workloads driven by an array of factors including surging homebuilding activity , greater infrastructure spending and renewed confidence within the commercial development sector.

“A broad-based upturn in construction demand has created a boom in job creation this summer, as construction companies look to replace capacity lost in the aftermath of the recession.

“However, acute skill shortages meant that subcontractor charges rose at the fastest pace since the survey began in 1997.

“Meanwhile, subcontractor availability fell at a survey-record pace, which could act to further ignite pay pressures in the short term.

“Supply chain pressures intensified during August, as falling stocks and strong demand for inputs contributed to the steepest lengthening of vendor delivery times since the survey began 17 years ago.

“ While some survey respondents noted optimism that additional supplier capacity will come online over the near term, construction companies were generally less sanguine in relation to their staff hiring difficulties , reflecting concerns about protracted growth pains in this area.”